ACH (Automated Clearing House) transactions have become an integral part of our modern financial system. They allow for the electronic transfer of funds between different bank accounts, making transactions faster, more convenient, and cost-effective. Whether you are a business owner, a financial professional, or an individual, understanding how to track...

What is an ACH Return? Everything you Need to Know

In today's digital age, electronic payments have become the norm for businesses and individuals alike. One of the most popular methods of electronic payment is the Automated Clearing House (ACH) network. ACH transactions allow for the seamless transfer of funds between bank accounts, making it a convenient and efficient option...

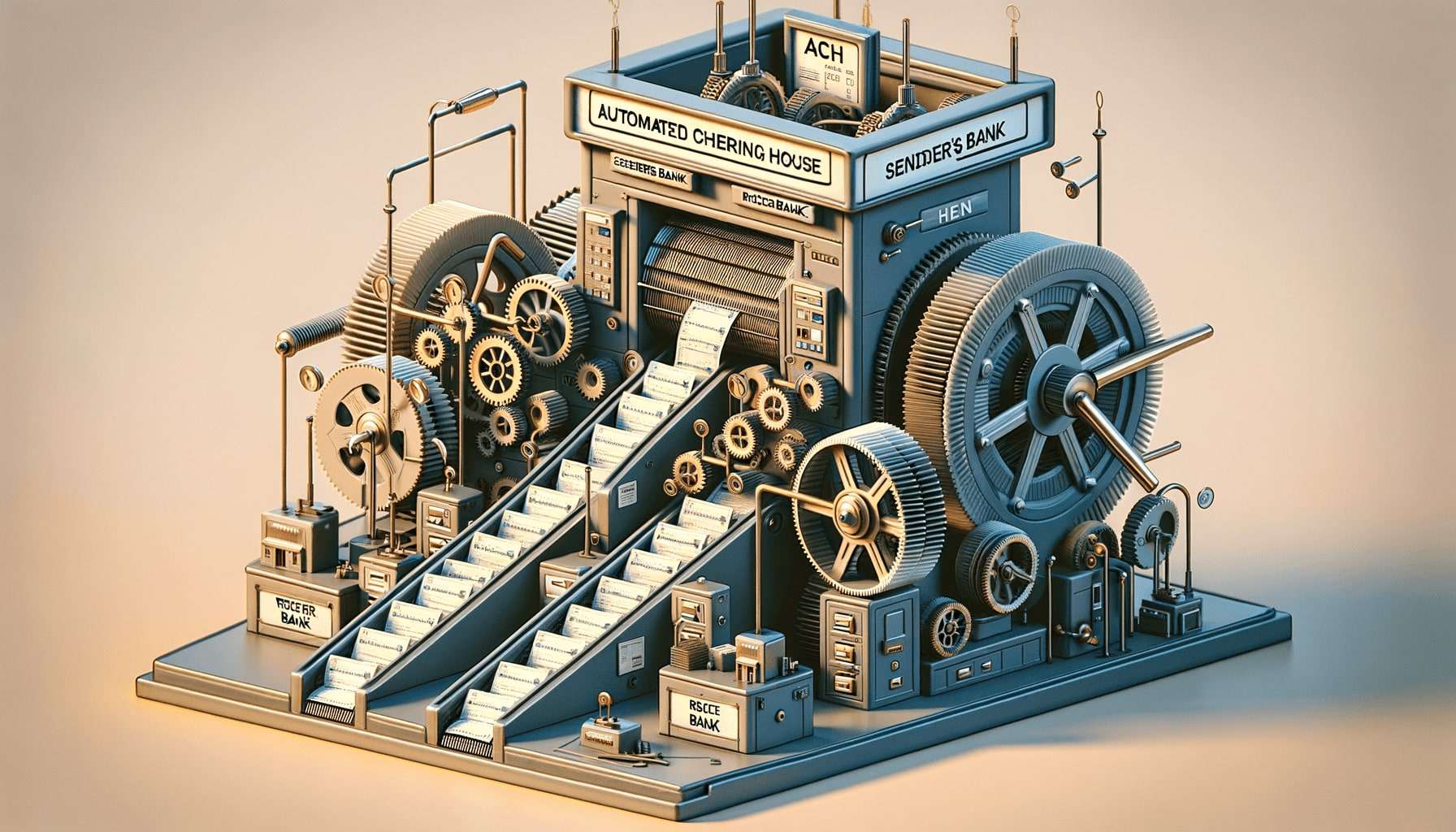

What Is an ACH Transfer? How It Works

In today's digital age, electronic payments have become the norm for businesses and individuals alike. One such method is the Automated Clearing House (ACH) transfer, which allows for the seamless transfer of funds between bank accounts. Whether you're a business owner looking to streamline your payment processes or an individual...