By Crystal Hopkins March 3, 2025

In today’s digital age, convenience and accessibility are paramount when it comes to financial transactions. One such convenience is the ability to withdraw cash directly from a point-of-sale (POS) terminal. Point-of-sale withdrawal, also known as cash back, allows customers to withdraw cash from their bank account during a purchase transaction at a retail store or merchant.

This innovative feature has gained popularity due to its convenience and time-saving benefits. In this comprehensive article, we will delve into the meaning, concept, working, benefits, factors to consider, concerns, security, and best practices of point of sale withdrawal.

Understanding the Concept of Point-of-Sale Withdrawal

Point-of-sale withdrawal refers to the process of obtaining cash from a retailer or merchant at the time of making a purchase. Traditionally, customers had to visit an ATM or bank branch to withdraw cash. However, with the advent of technology and the integration of banking services into retail systems, customers can now conveniently withdraw cash during their shopping experience. This feature is especially useful for individuals who prefer to carry minimal cash or find themselves in need of cash in situations where card payments are not accepted.

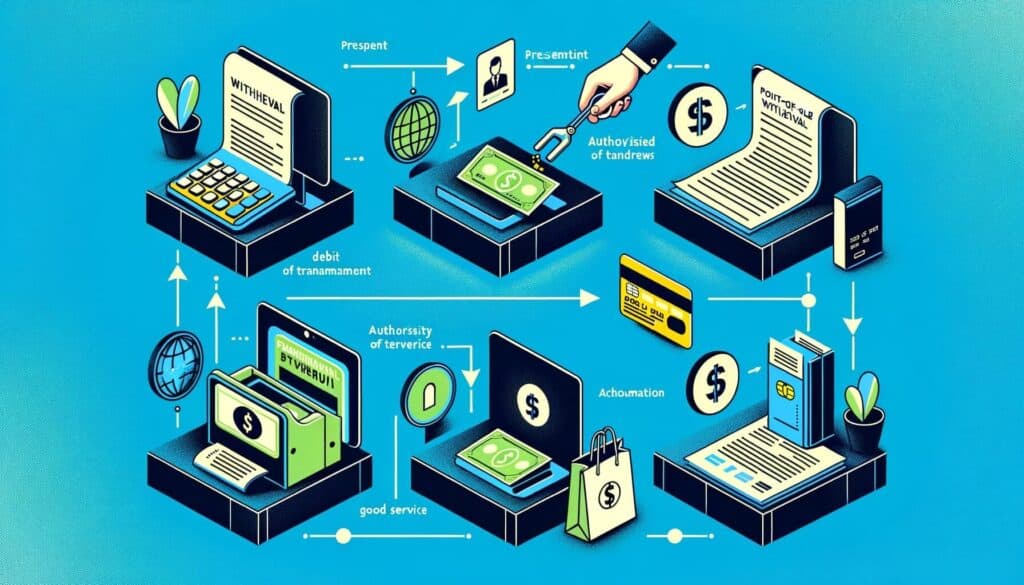

How Point-of-Sale Withdrawal Works: A Step-by-Step Guide

To understand how point-of-sale withdrawal works, let’s walk through a step-by-step guide:

Step 1: Select a Retail Store or Merchant: Look for a retail store or merchant that offers point of sale withdrawal services. This information can usually be found on the store’s website or by contacting their customer service.

Step 2: Make a Purchase: Once you have selected a store, proceed with your purchase as you would normally. Choose the items you wish to buy and proceed to the checkout counter.

Step 3: Request Cash Back: When the cashier asks for your payment method, inform them that you would like to make a point-of-sale withdrawal. Specify the amount of cash you would like to withdraw in addition to your purchase total.

Step 4: Enter Your PIN: The cashier will enter the purchase amount into the point-of-sale terminal. You will then be prompted to enter your PIN on the terminal’s keypad to authorize the transaction.

Step 5: Confirm the Amount: After entering your PIN, the terminal will display the total amount, including your purchase and cash withdrawal. Verify that the amount is correct before proceeding.

Step 6: Collect Cash and Receipt: Once you confirm the amount, the cashier will hand you the requested cash along with a receipt for the transaction. Ensure that you keep the receipt for your records.

Benefits and Advantages of Point-of-Sale Withdrawal

Point-of-sale withdrawal offers several benefits and advantages to both customers and retailers. Let’s explore some of the key advantages:

1. Convenience: Point of sale withdrawal eliminates the need for customers to visit separate ATMs or bank branches to withdraw cash. It allows them to obtain cash during their regular shopping trips, saving time and effort.

2. Time-Saving: By combining the purchase and cash withdrawal processes into a single transaction, point-of-sale withdrawal saves customers valuable time. They can complete their shopping and cash needs in one go, avoiding the need for additional trips.

3. Lower Fees: Some banks and financial institutions charge fees for ATM withdrawals. With point of sale withdrawal, customers can often avoid these fees, making it a cost-effective option.

4. Increased Security: Carrying large amounts of cash can be risky. Point-of-sale withdrawal reduces the need to carry excessive cash, making it a safer option for customers.

5. Enhanced Cash Flow: For retailers, offering point of sale withdrawal can increase cash flow. Customers who withdraw cash during their purchase are more likely to spend that cash at the same store, boosting sales.

Factors to Consider Before Using Point-of-Sale Withdrawal

While point-of-sale withdrawal offers numerous benefits, there are certain factors that customers should consider before utilizing this service. These factors include:

1. Availability: Not all retail stores or merchants offer point-of-sale withdrawal services. Before relying on this feature, ensure that the store you plan to visit provides this option.

2. Transaction Limits: Some retailers impose limits on the amount of cash that can be withdrawn through point of sale withdrawal. Check with the store to determine if there are any restrictions on the amount you can withdraw.

3. Fees and Charges: While point of sale withdrawal can help customers avoid ATM fees, some retailers may charge a nominal fee for this service. Familiarize yourself with any associated fees before making a withdrawal.

4. Compatibility: Point-of-sale withdrawal requires a compatible bank account and debit card. Ensure that your bank and card are compatible with the retailer’s point-of-sale system before attempting a withdrawal.

5. Security Measures: It is essential to be cautious when entering your PIN at a point-of-sale terminal. Ensure that no one is observing your PIN entry and be vigilant against any suspicious activity.

Common Concerns and Misconceptions about Point-of-Sale Withdrawal

As with any financial transaction, there are common concerns and misconceptions surrounding point-of-sale withdrawal. Let’s address some of these concerns and debunk any misconceptions:

1. Security: One common concern is the security of point of sale withdrawal. Customers may worry about the safety of their personal information and the potential for fraud. However, point-of-sale withdrawal is generally considered secure, as it follows the same security protocols as regular card transactions.

2. Cash Availability: Some customers may worry about the availability of cash during point of sale withdrawal. However, retailers typically maintain sufficient cash reserves to accommodate customer withdrawals. In rare cases where cash may not be available, the cashier will inform you before completing the transaction.

3. Transaction Fees: While some retailers may charge a nominal fee for point-of-sale withdrawal, it is important to note that this fee is often lower than the fees associated with ATM withdrawals. Customers should inquire about any fees before making a withdrawal.

4. Compatibility Issues: Another concern is the compatibility of point of sale withdrawal with different banks and card issuers. However, most major banks and card issuers support this feature. It is advisable to check with your bank or card issuer to ensure compatibility before attempting a withdrawal.

Is Point-of-Sale Withdrawal Secure and Safe?

Security is a paramount concern when it comes to financial transactions. Customers often wonder if point-of-sale withdrawal is secure and safe. The answer is yes, point of sale withdrawal is generally considered secure. Here are some reasons why:

1. Encryption: Point-of-sale terminals use encryption technology to protect the transmission of data between the terminal and the bank’s authorization system. This ensures that sensitive information, such as your PIN, is securely transmitted.

2. PIN Protection: When entering your PIN at a point-of-sale terminal, it is important to shield the keypad from prying eyes. By taking this precaution, you can minimize the risk of unauthorized individuals obtaining your PIN.

3. Fraud Monitoring: Banks and financial institutions have robust fraud monitoring systems in place to detect and prevent fraudulent transactions. If any suspicious activity is detected, the transaction may be declined, and the customer will be notified.

4. Liability Protection: In the event of unauthorized transactions, customers are protected by liability policies provided by their banks or card issuers. It is important to promptly report any unauthorized transactions to your bank to ensure appropriate action is taken.

Tips and Best Practices for Using Point-of-Sale Withdrawal

To make the most of point-of-sale withdrawal and ensure a smooth experience, consider the following tips and best practices:

1. Plan Ahead: Before visiting a retail store, check if they offer point-of-sale withdrawal services. This will help you avoid any disappointment or inconvenience.

2. Verify Cash Availability: If you specifically require a large amount of cash, it is advisable to call the store in advance and confirm the availability of cash for withdrawal.

3. Protect Your PIN: When entering your PIN at a point-of-sale terminal, shield the keypad from prying eyes. This will help prevent unauthorized individuals from obtaining your PIN.

4. Keep Receipts: Always keep the receipt provided by the cashier after a point-of-sale withdrawal. This will serve as proof of the transaction and can be useful for record-keeping purposes.

5. Monitor Your Account: Regularly review your bank statements and transaction history to ensure that all point-of-sale withdrawals are accurately reflected. If you notice any discrepancies, promptly contact your bank or card issuer.

Frequently Asked Questions about Point-of-Sale Withdrawal

Q1. Can I withdraw cash using point-of-sale withdrawal without making a purchase?

A1. No, point-of-sale withdrawal requires a purchase transaction to be initiated. You cannot withdraw cash without making a purchase.

Q2. Are there any limits on the amount of cash I can withdraw through point-of-sale withdrawal?

A2. Some retailers impose limits on the amount of cash that can be withdrawn. It is advisable to check with the store beforehand to determine if there are any restrictions.

Q3. Can I use point-of-sale withdrawal with a credit card?

A3. Point-of-sale withdrawal is typically available only for debit cards linked to a bank account. Credit cards are not usually eligible for this service.

Q4. Are there any fees associated with point-of-sale withdrawal?

A4. While some retailers may charge a nominal fee for point-of-sale withdrawal, it is often lower than the fees associated with ATM withdrawals. Inquire about any fees before making a withdrawal.

Q5. Can I get a receipt for my point-of-sale withdrawal?

A5. Yes, the cashier will provide you with a receipt for the transaction. It is advisable to keep this receipt for your records.

Conclusion

Point-of-sale withdrawal has revolutionized the way customers access cash during their shopping experience. This convenient feature allows individuals to withdraw cash directly from a retailer or merchant, eliminating the need for separate ATM visits. With its time-saving benefits, increased security, and cost-effectiveness, point-of-sale withdrawal has become a popular choice for many consumers.

By understanding the concept, following best practices, and considering relevant factors, customers can make the most of this innovative service. So, the next time you find yourself in need of cash, consider utilizing point-of-sale withdrawal for a seamless and convenient experience.